City Tax Guidance for San Antonio Businesses

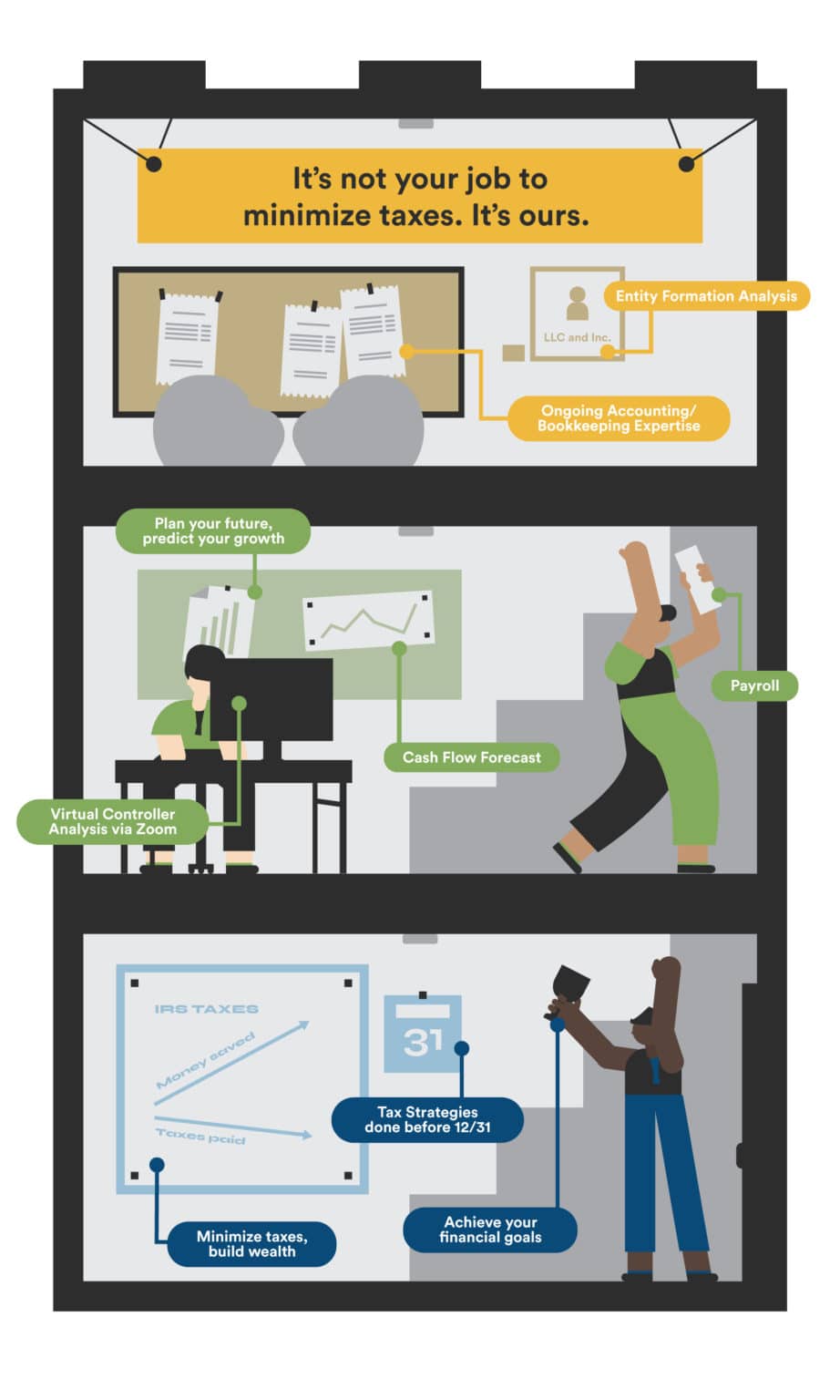

Minimize taxes

They are hired by their clients to help them, but they also have to remember that they owe the IRS and must not break any laws nor assist others in filing a fraudulent tax return. CPAs are experts who can help individuals and companies maintain financial records, prepare and file federal and state taxes, and ensure accuracy. They can defend taxpayers before the IRS. San Antonio CPA firms are committed to offering personalized, professional services to both individuals and businesses, including in the areas of tax preparation and financial planning.

With confidence, form your LLC or corporation. Insogna CPA . We will also prepare your return to ensure that it is accurate and complete. What qualifications are required?

This will allow you to focus on the next step. C-Corps are taxed as corporations. Contact us to find out more about what we can do for you!

Individuals and businesses in Texas may be responsible to pay a number of taxes such as property taxes and franchise taxes. You can either sit on your couch or pull up a seat in our office. If your business earns $100,000, the IRS will deduct corporate taxes from that amount before it is distributed to shareholders.

City Tax Guidance for San Antonio Businesses - Individual retirement accounts

- Tax preparation

- Capital gains taxes

- Mergers and acquisitions