Need a Power of Attorney? Tax Help in San Antonio Can Assist

income

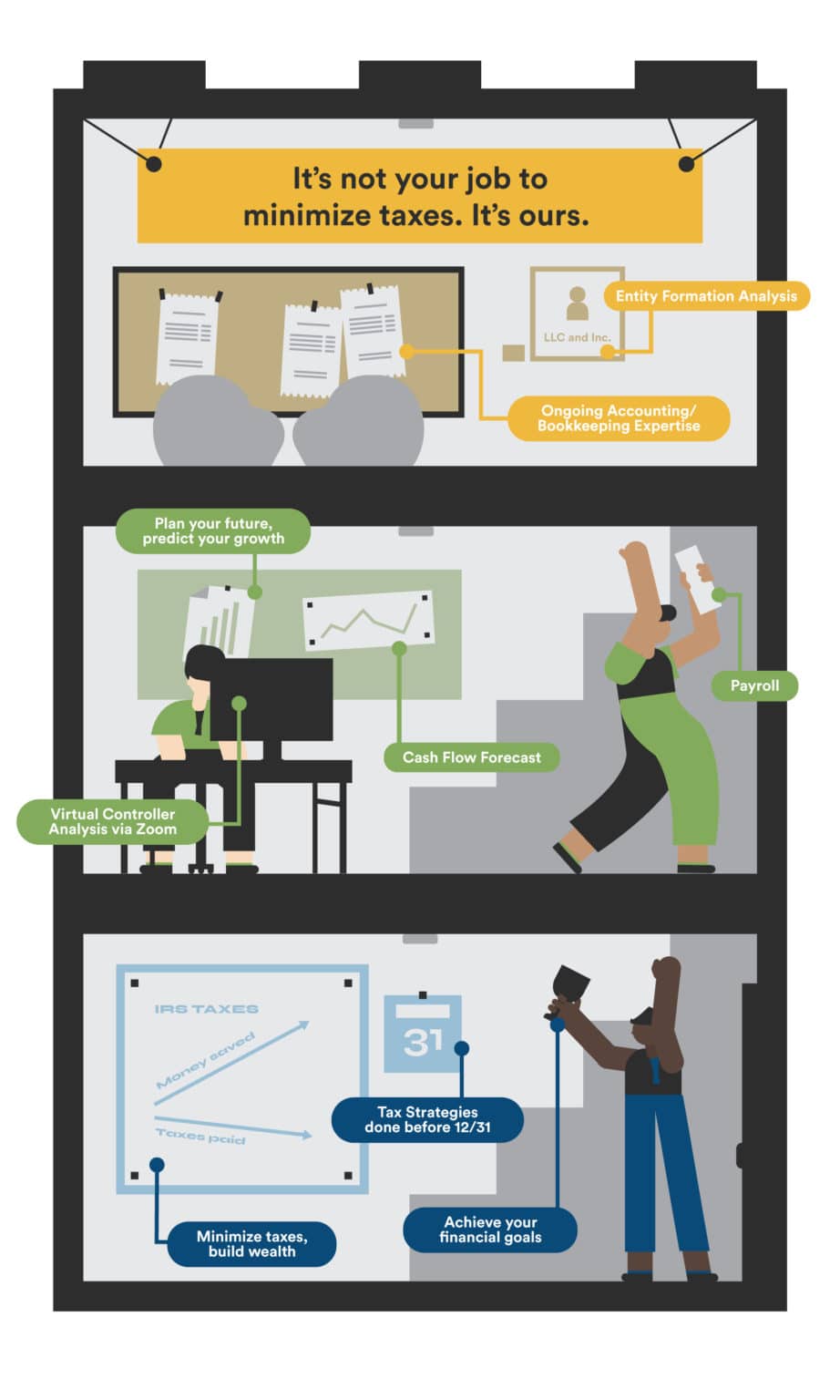

The following are just a few of the many services that a Houston CPA can provide. Our tax experts can help you, whether you are a small team or ten people.

Need a Power of Attorney? Insogna CPA S Corp Tax Preparation in Texas . Tax Help in San Antonio Can Assist - Financial modeling

- Tax advantaged accounts

- Financial modeling

- First time abate

Continue reading to find out more about S-Corps, and how we can lower your tax bill. We will assist you in planning, preparing and filing your taxes, whether you're an individual or small business. Tax planning can be confusing, especially when you don't know where to begin.

Tax professionals can help you increase your bottom line by finding all available credits and deductions relevant to your industry. Contact us to begin your 1120 S Corporation tax preparation today! We will collect all of the forms and statements required to prepare your tax returns after an initial consultation.

They can also resolve any issues that may arise. Audits and tax court matters are included.