Tax Lien Removal Services in San Antonio

QSBS

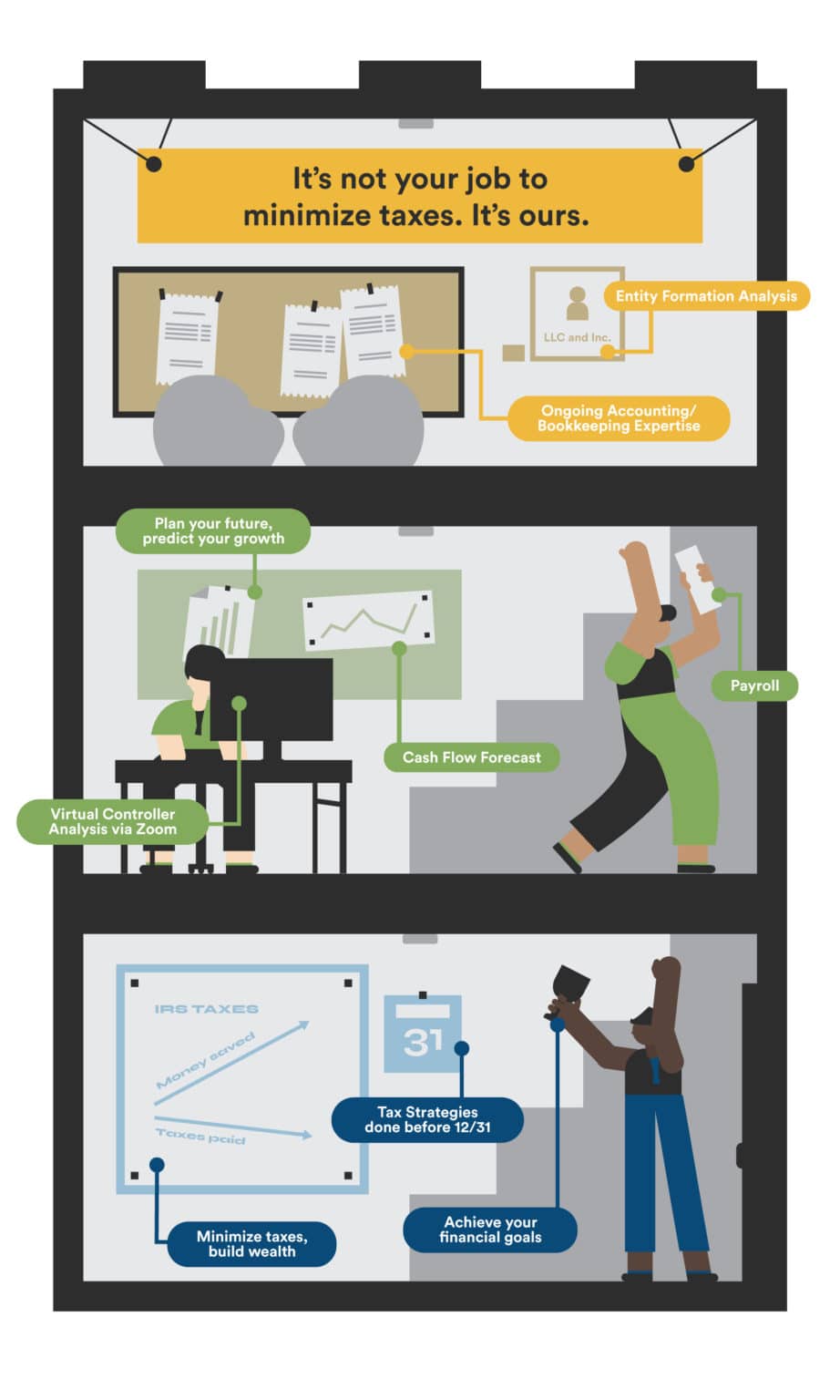

Our expert accountants prepare your taxes, check them with our other team members, and then electronically file them. S Corp Tax Preparation in Texas Insogna CPA . Stay on top of the latest laws and protect yourself from being audited: Corporate Transparency act and reasonable compensationInsogna is the best choice for all of your S-Corporation Tax Preparation needs.

Tax Lien Removal Services in San Antonio - QSBS

- Tax attorney

- Transfer pricing

- Tax advisory services

What does a tax professional do every day? Tax preparation is an increasing career and provides a much-needed service to the local community. Consider having someone else do your taxes to save you time and reduce stress.

A CPA can help you to understand the latest tax changes and answer any questions you might have. You can get a free transcript if you forgot to print your return. How do you become an accountant?

Don't delay if you require accounting services. Without your consent, Free File partners are not allowed to use or disclose tax return data for any other purpose than preparing tax returns. These companies also have to comply with the IRS eFile regulations and Federal Trade Commission Privacy and Safeguards Rules.