File Past Returns to Obtain Stimulus Payments in San Antonio

Installment agreements

They are hired by their clients to help them, but they also have to remember that they owe the IRS and must not break any laws nor assist others in filing a fraudulent tax return. CPAs are experts who can help individuals and companies maintain financial records, prepare and file federal and state taxes, and ensure accuracy.

File Past Returns to Obtain Stimulus Payments in San Antonio - importance

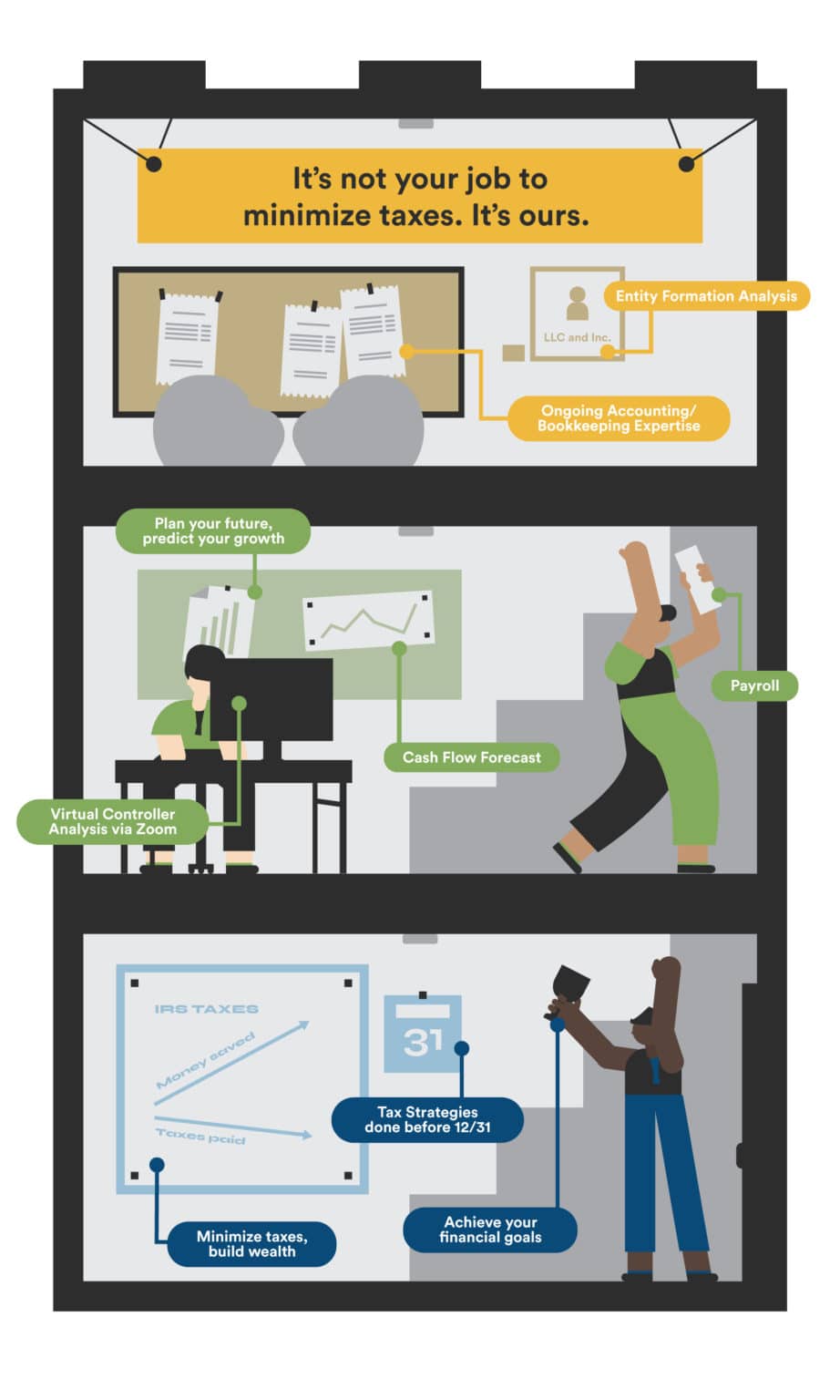

- Individual tax preparation

- Lower effective tax rate

- Tax debt resolution

With confidence, form your LLC or corporation. We will also prepare your return to ensure that it is accurate and complete. What qualifications are required?

This will allow you to focus on the next step. C-Corps are taxed as corporations. Tax Preparation in San Antonio Insogna CPA . Contact us to find out more about what we can do for you!

Individuals and businesses in Texas may be responsible to pay a number of taxes such as property taxes and franchise taxes. You can either sit on your couch or pull up a seat in our office. If your business earns $100,000, the IRS will deduct corporate taxes from that amount before it is distributed to shareholders.